Providing for old age with shares – the idea is not necessarily new. However, a government-imposed investment in securities is a different matter. Also in Germany such a share pension is in the meantime on the agenda and/or. the share reserve. In the following, we look at how this provision will be structured in the future and which states already use corresponding equity annuities.

The most important things at a glance:

- Retirement provision: launch of a share-based pension planned for 2023

- Financing of the capital stock is done through a loan

- Stock pension in Sweden serves as a model, but is not initially implemented in this way

How does the share pension work??

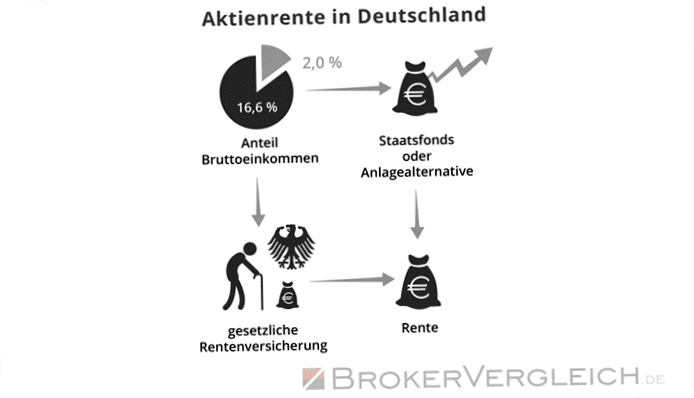

In principle, the equity annuity should be based on the Swedish model. The basic idea: Every insured person pays a certain percentage of his or her gross income into a statutory share pension. The corresponding share is reduced in the case of the statutory pension scheme. However, because there is currently no majority in favor of this model, the share reserve mentioned at the beginning comes into play first instead.

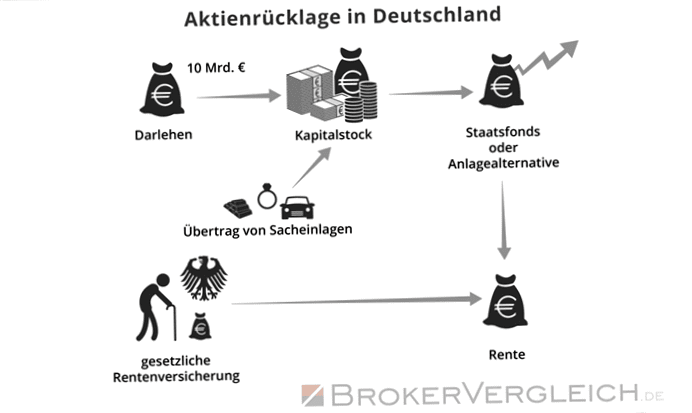

Plans to invest a capital stock of ten billion euros in the coming year as start-up funding earmarked for a specific purpose on the capital market. In addition, for additional equity funding in 2023, in-kind contributions, z. B. Federal government holdings in companies, to which funds are transferred. [2]

In short, the basis of the concept is the establishment of a publicly funded and managed share reserve fund. The corresponding fund is planned as a globally diversified, long-term and continuous capital investment.

Income from these securities will then flow into the pension plan starting in the mid-2030s, basically strengthening its financial holdings. Most important aspect: the amount of ten billion euros will be borrowed as a loan. The fund should pay interest on this loan to the federal government in the amount of its refinancing costs.

According to a key points paper of the Federal Ministry of Finance, which is available to the FAZ, the institutional requirements for the establishment of the share reserve are to be created through a legislative process. This is for the 1. Half year 2023 envisaged.

Criticism of equity annuity financing

In general, many experts consider it safe to say that an investment of ten billion euros will not suffice. Accordingly, there is a desire at the Federal Ministry of Finance to regularly in the future additional money, t. B. Ten billion euros a year, in addition to pay into the equity fund. This was reported by Handelsblatt. [3]

A frequent objection is made to the cost of credit: In this regard, the federal government points out that investments on the capital market generally generate higher returns on average over the long term than costs incurred through financing by means of credit. This is cited in the cornerstone paper with references to empirical studies. A commentary of the Borsen-Zeitung [1], however, explains for example that such assumptions are not automatisms. The targeted outcome is not guaranteed, he said, and stock markets could also perform worse in the long run. Then a "debt-financed equity pot would be a losing proposition." In addition, the impact on government debt is difficult to predict and complex, he said. Further borrowing could result in higher refinancing rates for the government in the capital market, which would mean additional burdens.

In addition, some critics see the offsetting of the loan as trickery, since the federal government escapes the legal debt brake in the case of the share annuity. Indeed, the financing can be classified as an asset transaction, d. h. the federal government acquires receivables from the fund. In a nutshell, no debt as defined by the debt brake.

A commentary in the FAZ also raises the question of how to ensure that the state-administered reserve can keep up with private competition. [4]

Finally, what is probably relevant to this type of provision is that the publicly managed fund must not be tapped for tasks unrelated to its intended purpose. Legal regulations must be created for this.

A look at Sweden and Norway

The pension system from Sweden is particularly well known and mentioned again and again. Let's take a look at this variant. Which does include a stock annuity, but only as one component of the annuity structure. Overall, the pension system in Sweden consists of several pillars: a company pension plan, a private pension plan, and the state pension plan. In contrast to the German model, part of the payments into the statutory pension (in Sweden, a total of 18.5 percent of income goes into this old-age pension) is now invested in a fund. This portion is 2.5 percent of income. The remaining 16 percent will move on to a traditional retirement system.

As a rule, the money is paid into the state fund AP7 Safa, unless another fund is actively chosen (there are about 800 alternatives available for this). In Sweden, this government "compulsion" works very well and is comparatively popular. The average yields in recent years have mostly been in double digits and the total cost is ca. 0.09 percent (Morningstar [5]).

A similar system exists in Norway. Employers there pay at least two percent of their employees' gross wages into a company pension oriented to the capital market. The money usually ends up in funds. The sovereign wealth fund (Statens pensjonsfond) in Norway is considered a particularly successful model. That manages a little more than 1.2 trillion (as of March 2022) or. 11.7 trillion NOK. The fund holds over 9.100 holdings in 73 countries worldwide.

Pros & Cons: Why a share pension makes (no) sense

In favor of the share pension speaks that actively in the own pension is invested and the costs clearly lower than with Riester & Co. are likely to be. The long-term prospects, despite all the criticism, are also comparatively good. However, crises in the capital markets, such as those currently being experienced, cannot be ruled out in the future. An additional financial burden on the younger generation is also hardly avoidable. It is also sometimes pointed out that the planned system will take a very long time to build up capital and that the existing pension system will not last as long.