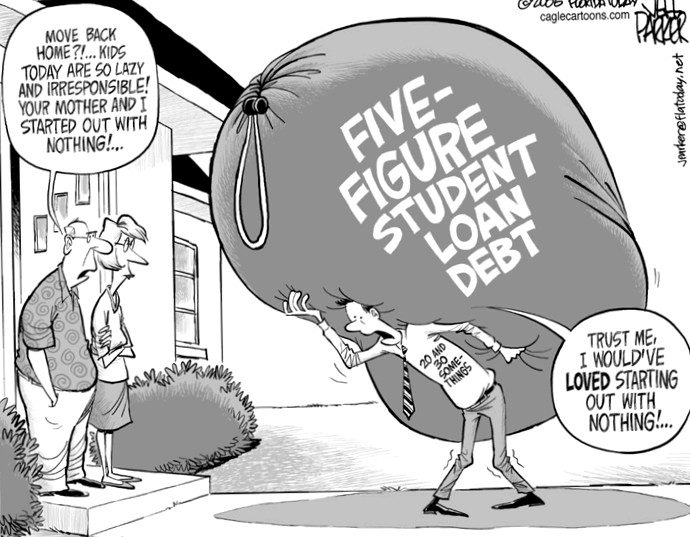

Everyone knows that student loan debt has become a massive problem here in Germany. Even though I'm not a student yet, I'm amazed at the enormous debt some people have after graduation. The Consumer Financial Protection Bureau reports, "Our initial findings on the size of the private student loan market are sobering. When we add in the outstanding debt in the federal student loan program, it appears that outstanding student loan debt reached the trillion dollar mark a few months ago – much larger than estimates in other recent reports."

One trillion dollars? Yikes. I guess I need to take a quick breath into a paper bag. With college only a few years away, I've set my sights on graduating college with no debt at all. I know this will be difficult, but I'm convinced it's not impossible after doing a little research and thinking. Here are five strategies to avoid student loan debt:

1) Start saving your money now

If you're a teenager, starting to save your money in college will make a big difference for you. Even if you save only €25 per month from the age of fifteen, you would have €1200 by your nineteenth birthday. That's not much, but it's better than nothing. If you saved €100 a month, you'd have €4800. Not bad ..

2) Work during the summer, school vacations, and during school hours

If you are really diligent, you can earn over €2 in a typical summer.Save 000 (assuming you live at home and work for minimum wage). You can continue to earn money during the school year so that you have money to support yourself. Just recently, I discovered that students can take out loans for living expenses – and some get a kick out of buying expensive clothes, eating out at fancy restaurants and other shenanigans. Waaaaaaas. Of course, when they graduate and can't find a job that pays them €100 000 a year, life won't be quite so fun anymore. Especially when they find that they can't buy their first home because their student loan installments are higher than the average monthly mortgage payment…

3) Apply for scholarships

You already know this, so I'll just say that while it's a hassle to fill out all those applications, it doesn't hurt to try, and can make a big difference for you financially. The sooner you start, the better.

4) Attend a community college

You can save a lot of money by going to your local community college for the first two years. And your savings become much more significant if you do this AND continue to live at home. This is what I plan to do. Having a nice apartment with a few girlfriends sounds really great, but paying off student loans for the rest of my life just isn't appealing, you know?

5) Visit a school that is committed to helping its students graduate debt free

I recently heard about Davidson College, which is located just north of Charlotte, North Carolina. Their board did something extraordinary and created the Davidson Trust. This small school has enabled students from all economic backgrounds to graduate without debt. Other schools have also followed Davidson's lead. So carefully research schools that you thought were too expensive to even consider.

These are some of the strategies I will use when it is my turn to start college life. It's so exciting to think that if I work hard and plan carefully, I can look forward to college without the "gift" of loan debt. It's certainly a gift that keeps on giving, and I want nothing to do with it…

How will you avoid student loan debt?

The misadventures and gossip of a neurotic girl roaming the world … this is my journey. From start to finish, I want to share my stories of how I left behind the dream of an unattached life. I hope you will join me on this journey.