Many people dream of being their own boss, to realize their career and to have economic success. But the road ahead is rocky and full of challenges. Last but not least, it is important to build up a sustainable pension plan that ensures a standard of living in old age. Different models have proven to be successful or rather excluded.

Anyone who sets up their own business in Germany not only has to come up with a good business idea and be profitable, but also has to comply with all kinds of official and statutory requirements. Depending on the branch it takes

- A trade license

- an application for a tax number at the relevant tax office

- the establishment of the company in the appropriate business form

- the keeping of appropriate accounts

- Sick resp. Social security

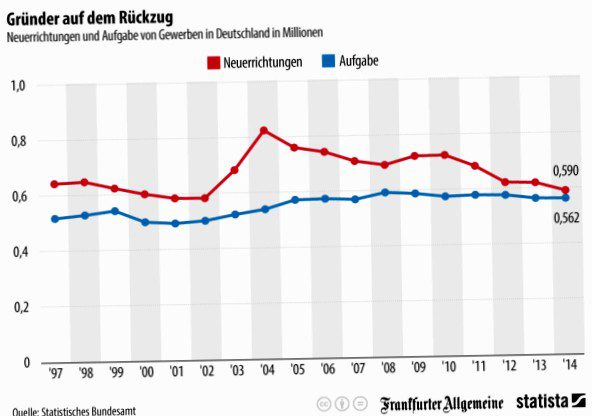

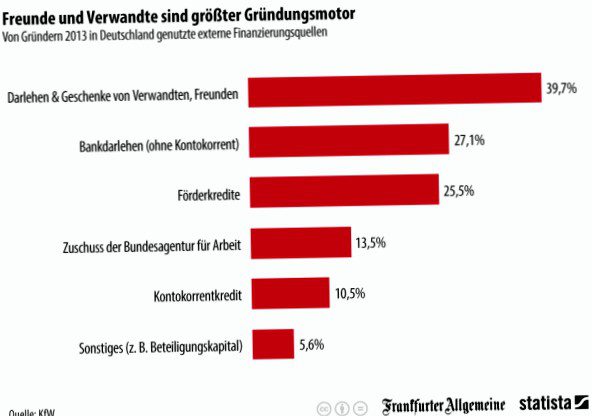

If you take a closer look at last year's statistics, you'll see that almost as many people took the plunge into independent living as those who ended it again. For both groups, the figure for 2014 is just under half a million. Almost 40 percent have chosen a traditional limited liability company, 27 percent are sole traders. What is striking when looking at these statistics is that there are still more male founders than female founders, and the types of financing are also very distinct.

- 39 percent Loans and gifts of money from friends and family

- 27 percent rely on a bank loan

- 25 percent receive corresponding subsidized loans

- 13 percent receive a subsidy from the employment agency

- 10 percent rely on an overdraft facility

This already shows how precarious the financial situation is for founders in Germany. Even if within short time quite yield is obtained, it is sufficient with the fewest for it to make actually precaution for the pension. Protecting one's standard of living and professional activities with appropriate insurance policies can also take bitter revenge in old age. Therefore, it is worthwhile to make appropriate provisions here. This year's KfW Start-up Monitor 2015 provides further information on the development of the start-up scene in Germany.

Financial future is based on two pillars

Securing the financial future should be done in two steps by a founder. On the one hand, it is necessary to hedge the risk and, on the other, to build up individual assets. The former is about transferring risks that threaten the existence of the company to the insurance company for the fee of an insurance premium. Wealth creation, on the other hand, means saving as much capital as possible and continuing to increase it through a return with a positive effect.

It is important to separate these two points and to take care of the risk coverage for the time being at the beginning of his independent professional career. The following are to be assessed as risks:

- Illness

- Occupational disability

- Liability claim

- Death

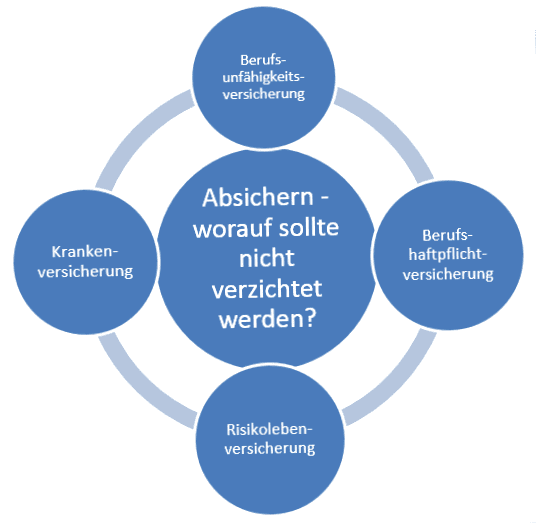

The elements of risk protection

The professional operational capability must be secured

Health insurance: as a self-employed person, health insurance is an absolute obligation, although it does not matter whether you choose a public or private option. It is also advisable to take out a daily sickness allowance insurance policy. This completely covers the loss of earnings during a prolonged period of illness. Usually this benefit is available in combination with the health insurance itself as an additional benefit.

Occupational disability insurance: occupational disability is also a high risk that can quickly threaten the existence of self-employed entrepreneurs. Even if it is difficult for many to imagine at a young age, it is important to consider the consequences if, for health reasons, you are suddenly no longer able to pursue your learned occupation, which may provide for the upkeep of your entire family.

Claims for damages can also be existentially threatening

Professional liability insurance: just as important as in private life is a liability insurance for a self-employed person. So in addition to private liability, you should think about taking out so-called professional indemnity insurance. While it is required by law for some professions, such as doctors or lawyers, people working in other industries should also consider taking out this policy. Because one thing is clear: anyone who negligently causes damage to property or personal injury must pay compensation, whereby you are liable with all your assets. This can put large parts of the income at risk, as there is the possibility of judicial seizure for the injured party.

Self-employed people with families should insure against death

Term life insurance: If you are self-employed and have a family that you support with your job, you also have to cover the risk for your descendants accordingly. Here a term life insurance is advisable. In contrast to endowment insurance, this is favorable in terms of premiums and at least secures financial affairs for surviving dependents. This, too, can be seen as a form of future or. pension provision and should not be disregarded.

Retirement savings are based on two systems

If the self-employed retire, there are two options as to how this can be obtained. In the so-called pay-as-you-go system, which is provided by the statutory pension insurance funds, pensioners receive the amount they are entitled to from the current contributions made by employees who are subject to compulsory insurance.

With a funded pension, on the other hand, in the final savings phase one simply lives off the capital that one has invested oneself during the years of the savings phase and, in the best case, has increased through good investments. For this to be the case, care should be taken to ensure that a high net return is achieved over a long period of time, although insurance solutions are not necessarily the best choice here during the initial accumulation phase.

Four options for long-term wealth creation

- Life or pension insurance without state subsidies

- Rurup pension as an example for state-subsidized insurances

- Real estate

- Investment in shares or bonds

Still a solid form of investment – investing in real estate. Picture source: 82094703 – Eurohaus © grafikplusfoto

Advantages and disadvantages of savings contracts without state subsidies

Here it is no longer a secret that insurance and financial advisors want to pass on to their clients precisely those products where they themselves earn the best commissions. Especially when life and annuity insurance policies have high maturity benefits, this is good business for advisors. And customers appreciate these pension products because they do not entail any risks and offer comprehensive security.

Those who opt for life insurance choose a policy that has a relatively high cost structure and is usually not geared to capital growth. In most cases, customers are lucky if they get the amounts they have paid in back again without any deductions. Experts assume a loss of return of around 1.6 percent per year. In addition, there is the inflation rate, which can be assumed to be another 2 percent. This brings us to 3.6 percent, which has to be earned by the life insurance policy, so to speak, in order to ultimately come out with a black zero in terms of returns.

Newly concluded life insurance policies are now only offered with a guaranteed interest rate of 1.75 percent, which is obvious since government bonds are paying interest at an all-time low. And it is precisely in these products that life insurance companies often and gladly invest. If the current low-interest phase persists even longer, investors must expect a negative return for the entire term, which would make it almost easier to simply store the money at home under the much-cited mattress.

A somewhat higher return is available for unit-linked life or pension insurance. Annuities, but they also tend to hide higher fees, again making net returns consistently low.

Many investors also ask themselves whether capital-forming life insurance policies suffer when unemployment benefit I or Hartz IV is drawn. According to the legal situation, ALG I has no effect on life insurance, with Hartz IV, however, the matter looks trickier – because in principle Hartz IV provides that the recipient must first finance his livelihood by still available assets. Only when this has been used up to fixed tax-free amounts is there a claim to the payments. This means, therefore, that the difference between the current surrender value of an endowment policy and the tax-free amount of the old-age pension must also be paid initially. Ergo Direkt explains the relatively complex issue in a technical article.

Insurance policies that are subsidized by the state are not always convincing either

Employees in Germany can "riestern" to have their retirement savings subsidized by the government. This is not possible for the self-employed, there is only the option of a Rurup pension, also known as a basic pension. This is a substitute for the statutory pension that salaried employees receive; in contrast, salaried employees can use Riester pensions to supplement their statutory and company pensions accordingly.

Due to the state subsidy, the products that may be called and offered as Rurup are strictly regulated. There are three options for the self-employed, namely

- conventional pension insurance

- unit-linked pension insurance

- Fund savings plan for the savings phase, later converted into pension insurance

Investment in productive capital as retirement provision

With this point, the topic changes from insurance to lucrative forms of investment for retirement planning. A security deposit can be a favorable measure here, in order to accumulate for its old age an appropriate fortune. Three points or. Ingredients are needed so that the deposit is also a guarantor for a relaxed retirement period. These are

- high return on investment

- low costs

- Risk diversification

Anyone who has followed the stock market recently will recognize that over the past 20 years, equities in particular have had the highest return of all asset classes. As far as keeping costs low is concerned, investing in ETFs, i.e. exchange traded funds, has proven to be a good idea. Those who keep such fund units for a long time can achieve good returns and have to accept low costs. These in particular also ensure that the risk diversification is small. Because ETFs usually contain shares and bonds from a wide range of different companies. This allows you to minimize the risk. An additional advantage of securities accounts is that there are no contractually fixed terms with fixed contributions, costs and fees. Apart from that you are not dependent on a single insurance company. You should accept that there may be fluctuations in the value of the portfolio, but you should not be unsettled by them.

Obligation to provide for old age to prevent Hartz IV

After all, just under 180.000 self-employed persons received Hartz IV benefits in addition to their professional activities last year. In order to make appropriate provisions here and prevent the number of pension recipients who rely on this state support from being similarly high or even higher, the government introduced the so-called old-age provision obligation in 2013. This should be the same in total as the basic insurance, according to the relevant paper of the Ministry of Labor. In plain language, this means that every self-employed person should make as much provision as possible so that in old age they are not reduced to the basic income support or. to be dependent on the unemployment benefit II – in numbers this means that he receives a minimum pension of ca. 660 euros per month must be earned. In fact, however, politicians are still more than divided on the implementation of the system, and according to various media such as Der Spiegel, the compulsory pension is already on the brink of being phased out.