You urgently need a loan in the amount of 35000 euros that will not tolerate any delay? Do you plan to buy a new car or renovate your apartment? Then additional funds are usually necessary, because the monthly salary is no longer sufficient to stem the high additional costs.

Compare 35000 Euro loan offers here – without obligation and SCHUFA-neutral!

In order to get the best offer for an individual 35000 Euro loan, you should definitely use the free loan comparison, because you have the best chance to get the best interest rate. You do not need to worry – the price comparison is completely SCHUFA-neutral and does not affect your credit rating!

The 35000 Euro credit as a loan

We usually use the terms "credit" and "loan" synonymously on Credit 123 for large sums of money. In the actual sense, the loan begins only with a term of 48 months, but since a 35000 Euro loan is usually taken anyway with a term of about 48 – 84 months, it just usually revolves around a 35000 Euro loan that is taken out.

However you want to choose the loan term – in any case, there are some requirements that you must meet in order to be able to apply for a loan at a German credit institution at all.

Important requirements for a 35000 euro installment loan from the bank

Before you can get a 35000 euro loan from Sparkasse, Postbank, Targobank, Commerzbank, DKB or one of the many other banks, you should familiarize yourself with the minimum requirements:

- You have the 18. You are over the age of 18 and are therefore of legal age.

- there is no mental impairment, so you are fully capable of doing business.

- You are registered in a German city or municipality and therefore have a residence in Germany.

- Your monthly salary is high enough to afford the monthly installments to repay the 35000 Euro loan.

- The check at SCHUFA showed that you have a high credit rating, so the probability of default is low.

If you can provide a permanent employment contract and check off all the above items, then the prospects of getting your 35000 Euro installment loan approved are favorable. In addition to private sector employees, civil servants and public sector employees often have little trouble meeting the minimum requirements. With entrepreneurs and self-employed people it can be different, and here additional documents must be provided.

Further documents necessary for the 35000 Euro loan for self-employed persons

In order to get the 35000 Euro loan for self-employed quickly and easily, you should prepare the following documents:

- Annual financial statements, company balance sheets or income statement (EuR)

- the tax assessment notices for the last few years, which have been sent to you by the tax office

- a business management analysis (also called BWA), which your tax advisor can prepare

- other proof of income, which can improve your credit rating, such as e.B. Income from funds and stock profits and rentals.

In the case of freelancers, tradespeople and self-employed persons, it is not always easy to clarify the individual income situation flawlessly. But if you provide the above documents and can prove that your income is high enough to reliably pay the intended monthly installments, you have a good chance to get the 35000 Euro loan for entrepreneurs.

Basically, however, you should distinguish between a consumer loan and a business loan. Here there can be sometimes considerable differences, and in general you should be able to define the purpose exactly and also communicate with the respective bank consultant. If you want to use a 35000 euro loan for any consumption purposes, then the probability of approval in doubt reduces.

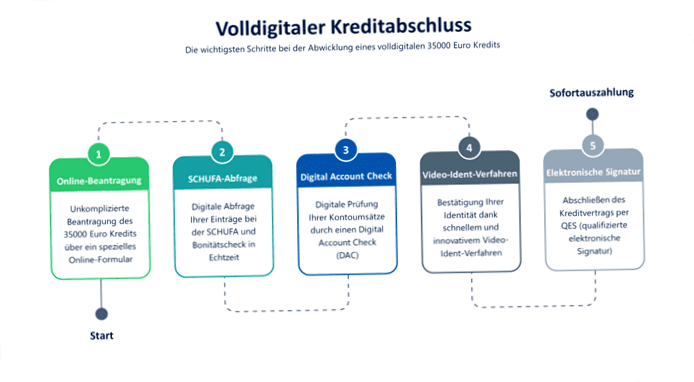

Fully digital 35000 Euro credit with instant decision and instant payment

You need your loan iHv 35000 euros particularly quickly and preferably without paperwork? In this case, thanks to digitalization, you can now take out a fully digital loan with instant decision and instant disbursement completely online. To print out salary slips, bank statements or salary notifications and then send them by mail is no longer necessary with this type of credit. This is because the credit check here is done in real time via Digital Account Check (DAC).

In this check, software accesses and evaluates your account data via an XS2A interface. The basic requirement for this is, of course, authorization by you! An algorithm then categorizes your income and expenses and creates a digital budget statement. Should the software be able to conclude from your bank data that you can easily qualify for the 35000 Euro instant loan, you can legally conclude the loan agreement via video-identification and digital signature!

DAC, Video-Ident and QES (qualified electronic signature) ensure that in the digital age there are indeed express loans in 30 min, lightning loans without paperwork and online loans with instant disbursement. An interesting fully digital credit offer is, for example, the Kredit2Day of smava GmbH, which is granted in cooperation with solarisBank AG. You can get more information about this interesting instant loan here!

Different reasons for a 35000 euro loan

As mentioned above, there can be many different reasons that you may want to take out a 35000 loan or. even must. Such amounts are often for a renovation of a house or apartment, or even for a car purchase, so that one can also speak of a housing loan or car loan.

Use as a 35000 euro debt rescheduling loan

The so-called debt restructuring is also a common reason. This involves replacing a loan from the past, which may have been made on suboptimal terms, with a new loan. It is also possible to "merge" several loans into one such debt restructuring loan. It is important, however, to first check whether a free unscheduled repayment is possible or the possible early repayment penalty manageable.

If the outstanding loan amount is high enough and you have good prospects of a significantly lower APR due to an improved credit rating, then you should take a look at the scenario in detail. In some cases, several hundred, if not thousands, of euros can be saved through appropriate debt restructuring.

Another good reason to reschedule your debt could be your overdraft. If you're constantly overdrawing your checking account and you're already a few thousand bucks in the red, overdraft interest can eat a big hole in your cash every month. If you can't even manage to cut back your overdraft to a healthy level, then you should also think about a debt restructuring loan, as you can end up saving a lot of money.

Improving your credit rating with loan collateral

If you are a "borderline" case that does not allow for an easy decision, then it is recommended that you put down additional collateral. If you are renovating your home, then the collateralization of the loan by your house or. Your condo sense. In the case of the car loan, the car would accordingly be conceivable as additional security. In addition to such real collateral, however, there is also personal collateral.

You can use the 35000 euro loan z.B. personal security if you name a guarantor. There is a basic distinction here between the directly enforceable guarantor and the default guarantor. Unlike a guarantor, another borrower is fully liable from the start, which is why this is also a welcome personal loan protection in the eyes of bankers. In most cases, family members or close acquaintances act as guarantors or take the place of a second borrower.

In some cases banks require that the spouse acts as a second borrower to reduce the risk of default on a joint loan. Tip: Even prospective civil servants can significantly improve their credit rating again by naming a second borrower, who ideally has a permanent employment contract and a high credit rating. Thus, the arguments are on your side, so that the loan at top conditions or. That the loan can be granted at the most favorable interest rate.

35000 Euro loan without SCHUFA?

It is no secret that your creditworthiness is checked in cooperation with SCHUFA Holding AG. This is part of the normal procedure at all German credit institutions, so you have little chance in this country to get a fast 35000 euro loan without SCHUFA query. In the past, there have been mainly Swiss banks that have included such loans in the portfolio, so they became better known as "Swiss loans".

Today, for legal reasons, it is banks from Liechtenstein and Luxembourg that can serve with such products, and they make such loans without SCHUFA pay well – the fees are considerable. You should be careful with credit institutions that even ask for upfront costs. Because usually it is then fraudsters, who make themselves after transfer of the preliminary costs from the dust, so that you go out completely empty.

Tip: Take a look at your individual SCHUFA file – the German credit agency offers you the opportunity to view the data once a year. The information collected on your credit history is the basis for the so-called SCHUFA score: If you have always paid off all loans and leasing installments, then this score is high and you have a good credit rating according to SCHUFA.

Alternative: 35000 Euro credit from private

If you have a negative SCHUFA because you have often failed to make payments in the past, this does not necessarily mean that you cannot get a loan at all. Thus, the 35000 euro loan from private may be an alternative for you. Thereby it is not a bank, which faces you as a financier, but a private person.

This can come from your circle of acquaintances or be anonymous to you. Unknown to you, you can find people through Internet platforms, whereby they charge fees for the mediation. However, if you draw a 35000 euro loan from a private person you know, then it is different.

So it may be that in very favorable cases you can even get a 35000 euro loan without interest and proof of income, because your rich uncle waives it. Make sure, however, also in such a constellation that everything is well documented and the loan agreement leaves no room for doubt. In addition, such a 35000 euro loan is to ensure that the tax office does not classify the transaction as a gift. In such a case, gift taxes could be due if the loan amount is above the gift tax allowance!

Conclusion to the individual 35000 euro credit

You see: There are many different ways how you can quickly and flexibly get a 35000 euro loan. Both with good credit rating and negative SCHUFA, although we clearly recommend that you turn to a reputable German bank for a solid installment loan if possible. Even if you do not draw an above-average salary, you can make up a few points by factual and personal collateral and negotiate good conditions with the bank advisor.

Find the best offer at the most favorable interest rate now with our free credit comparison. Try to choose a monthly installment as high as possible, because then you will have the lowest costs. At the same time, your monthly repayment shouldn't be the reason you're in financial trouble. In most cases, it is rather unrealistic that the 35000 euro loan can be paid back in 12 or 24 months.

On the other end, 108 or 120 months is already relatively long and equates to significantly higher borrowing costs. But it's best to see where you come out with a median term of 36, 48, 60 or 72 months, and whether that fits well into your budgeting plan.