You urgently need money in the form of a 50000 Euro loan? Then you've come to the right place at Kredit 123, as we show you the best way to get your flexible loan. Simply enter the desired loan term, and you will receive a calculation example of what the monthly payments might look like. Please note that the APR is usually particularly favorable if you choose a shorter term.

Compare SCHUFA-neutral attractive 50000 Euro credit offers!

Important requirements for taking out a 50000 euro loan at a bank

If you want to take out a cheap 50000 Euro installment loan from Commerzbank, Raiffeisenbank, Targobank, Sparkasse, Santander Consumer Bank or any other bank in Germany, then basically the following points are checked:

- Are you already of age and have reached the age of 18. Over the age of 18?

- Do you live in Germany and can prove official residence in the FRG?

- Is your business and creditworthiness unrestricted??

- Draw a regular income high enough to be able to pay the monthly installments for the 50000 euro loan?

- Achieve a high SCHUFA score, which certifies a high creditworthiness on your part?

If you have a good job and can provide the appropriate proof of income, then the approval is there relatively quickly, so that the money can be paid out to you in just a few banking days and without major problems. Private sector employees, public sector employees and civil servants are among the groups of people who can usually get a 50000 euro loan without any major problems.

But for freelancers, self-employed and entrepreneurs, the verification of the necessary income is often more difficult, which is why the 50000 Eure loan for self-employed still require additional papers.

Additional requirements for the 50000 Euro loan for self-employed persons

As a self-employed person, you should have the following documents ready to apply for and take out a 50000 Euro loan:

- Balance sheets, financial statements and/or EuRs for the last few years

- a business management analysis (BWA)

- Tax assessment notices from the tax office, which provide information about your last tax payments

- further proof of income, which z.B. Go back on stock gains or rental income

In some cases, however, even this is not enough, so you can't avoid additional collateral for the loan. Of course, this applies not only to entrepreneurs and the self-employed, but also to other potential borrowers who do not have sufficient creditworthiness.

Additional loan collateral in the loan iHv 50000 euros

For higher loan amounts, it is not uncommon for personal and/or real loan collateral to be provided in order to reduce the lender's probability of default and to be granted better interest rates via this route. In terms of personal collateral, for example, the guarantee is widely known. Here, for example, a family member steps into the scene and vouches for the borrower on a directly enforceable basis or as a deficiency guarantor.

Indemnity bond and directly enforceable guarantee

Whereas in the case of a deficiency guarantee, the guarantor does not have to step in until the borrower is no longer able to pay his loan installments and has already had to endure foreclosure measures, a person who has signed a directly enforceable guarantee must be liable immediately in the event of payment default. The latter variant of the guarantee is relatively popular with banks, especially since the guarantor in this case has a similar liability as a second borrower.

Adding a second borrower

If a second borrower is added by the main applicant, this is liable from the outset for the repayment of the loan debt with. Unlike the directly enforceable guarantee, the second borrower has a say in the use of the loan amount. In principle, both applicants have the same rights and obligations.

The addition of a second borrower is seen by creditors particularly positively, since here the credit risk is drastically reduced, and the bank consultant thus has more leeway to agree on particularly favorable conditions.

Tip: Even as a civil servant, z.B. as a teacher after the traineeship, it may make sense for you to involve another borrower with high creditworthiness, if you want to take out a 50000 euro loan. This can polish your already quite good status at the bank again additionally, so that you can get a really favorable top interest rate!

Real collateralization of the 50000 Euro loan

If you want to spruce up your home and take measures to increase its value, for example by installing dormers, renovating the bathroom or creating a beautiful garden, then you can deposit your house as collateral. Also with the car purchase a material credit security is conceivable, by transferring the car to the bank and becoming the actual owner only after paying off the full credit sum.

When taking out larger loan sums, real loan collateral such as the entry in the land register (land charge) as well as the motor vehicle security transfer of title for the lending bank is very interesting, it is very interested in the conclusion of a loan transaction in this magnitude. In fact, with a 50000 euro loan, it can generate good interest income even with very favorable APRs. Before applying for a 50000 Euro loan, make sure to check which loan collateral you can provide to reduce the interest burden! It is best to ask the bank advisor about all possible collateral options!

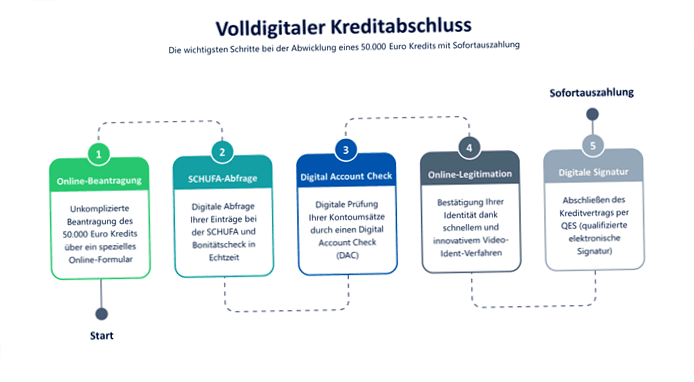

Fully digital processing of the 50000 Euro loan

While a few years ago it was quite normal to go to a bank branch to apply for and take out a loan, today – in times of digitalization – it is becoming more and more normal to apply for a 50000 euro loan online and to conclude the corresponding loan agreement digitally. Although not all banks offer a completely digital processing and credit application check yet. However it becomes from day to day more. So nowadays you can get a loan iHv 50000 euros not only from classic cooperative and branch banks, but also from various online and direct banks: as an instant loan.

With the 50000 Euro online loan you submit all documents and papers via upload. However, there are already lenders who can even offer the credit check completely digitally. The technology used here is called Digital Account Check. Via an interface, a software program reads out the bank data in your online banking account – after your authorization, of course – and then creates a digital budget statement. Based on this budget calculation, the loan approval or rejection is finally issued.

The confirmation of your identity does not take place on site in a bank branch and also not via Post-Ident procedure, but via Video-Ident or WebID procedure. As a rule, you download an app and then receive a video call, which is used exclusively for personal identification.

The loan agreement is also signed digitally, without you having to leave the house to do so. The technology behind this is called qualified electronic signature (abbreviated: QES). This procedure is, of course, legally valid and, in principle, relatively uncomplicated!

Due to the digital loan application review and processing, even loans iHv 50000 euros can be approved very quickly and also disbursed. Often only a few working days pass and the amount is already on your checking account. In the case of the online loan with digital account check, the credit approval even takes only a few minutes if you have sufficient creditworthiness. The Internet has truly revolutionized the lending process. Today, you can easily take out a real 50000 Euro instant loan if you contact the right banking institution.

Uses for a loan iHv 50000 Euro

Many people would like to take out a 50000 Euro installment loan at favorable conditions to renovate your home or buy a new car. Saving for a longer period of time is rather undesirable, as you don't want to wait for months on end. In such cases, it is important to apply for a dedicated loan iHv 50000 euros, in the case of renovation a modernization loan, in the case of buying a car a car loan.

Of course, you can also take out a pure consumer loan for free use. You should note, however, that this is usually more expensive than a loan for a specific purpose! This is because, for example, in the case of a car loan, the vehicle to be purchased can be provided as real collateral by way of transfer of ownership by way of security, and normally will be.

If a modernization loan is applied for, the lending bank knows that the applicant is a property owner. And this fact alone can already ensure that the credit seeker is granted a little more creditworthiness, even if the property to be modernized is not financially burdened at all in the end.

Use as 50000 Euro debt rescheduling credit

Anyone who may be carrying around one or more loans from the past should check whether it makes sense for them to take out a debt rescheduling loan. This is especially advisable if the interest rates that were once negotiated are very high, as the credit rating at the time has not yet been particularly good. If you are now in a much better position professionally, draw a higher salary and can also prove a correspondingly higher creditworthiness, then the 50000 Euro debt rescheduling loan could ensure that you save a lot of money in the end.

Check., whether an unscheduled repayment of the old contracts is economically reasonable. Some creditors require a so-called prepayment penalty, so that a fee is due if you want to shorten the originally agreed credit period. But even then it can be so financially advantageous if you make a debt restructuring that you should at least once calculate this step through.

How does it look with the 50000 Euro credit without SCHUFA?

Some people try to get a 50000 euro loan without SCHUFA query. This is often related to the fact that they have not made one or the other payment on time in the past and have fallen into arrears. Perhaps amounts had to be reminded more often or even collected by a debt collection procedure, or in extreme cases it has even come to execution.

Then you will find corresponding entries in the individual file at SCHUFA Holding AG in Wiesbaden. This credit agency collects to over 60 million. German citizens and companies relevant data to be able to draw a fairly accurate picture of the individual payment history on request. Based on this, the so-called SCHUFA score is then calculated, which in turn is the basis for whether you can be certified a good credit rating or not.

Tip: If you are in doubt about whether there are corresponding entries about you, then simply make an inquiry at SCHUFA. This transmits at least once a year free of charge this data to you. Incorrect or outdated entries can be corrected and deleted in this way!

All German banks check your creditworthiness by obtaining information from this German credit agency, formerly known as SCHUFA e.V. was known. If you are looking for a "real 50000 Euro loan without SCHUFA", then you can find at most abroad at comparably high interest rates and fees, from which we generally advise against a flat rate rather!

The possibility of the 50000 Euro loan from private sources

With the 50000 Euro loan from private you would not receive the money from a banking institution, but from a private person. This may or may not be close to you personally. In the first case, this person could be from your immediate circle of acquaintances or even a family member. Maybe you have a rich aunt or uncle who would be willing to help you out financially?

If you ask very dear, then you even get a 50000 Euro loan without interest, because your patron is particularly favorable to you and waives additional fees? In any case, you should also then draw up a written contract and document everything in detail, so that there is no family quarrel later on.

In the other variant, you would receive the 50000 Euro loan from an anonymous person who is referred to you via an Internet platform. Although there are still rather few websites in Germany that make this possible, and often at considerable fees for the mediation in addition to the high interest rates for the loan itself; but we wanted for the sake of completeness, this option not unmentioned.

Conclusion to the 50000 Euro credit / 50000 Euro loan

So there are several ways that lead to Rome and to your individual loan over 50000 euros, and from our point of view still the best option, times from the 50000 euro loan without proof of income and / or interest from the well-heeled relatives apart, is a clean installment loan from the bank.

Therefore, start now immediately the free loan comparison to find the best offer at the lowest interest rate. In addition to the traditional house banks, many new online banks have entered the market in recent years, which have really great products in the portfolio. By the way, you do not need to be afraid: Your test request is completely harmless and SCHUFA-neutral, so you need not have any fears that this will have a negative impact on your credit rating!

Just play around with the parameters and find out how the APR changes depending on the respective monthly installment or individual term. individual term. Try to be realistic when choosing the monthly installment to repay the 50000 euro installment loan – it should be neither too high nor too low and fit well into your budget planning for the next few years.