Most people would like to improve their credit rating. Aside from giving you more options for borrowing money, a good credit score makes it cheaper to use a credit card or get a loan. Credit Sesame, which has been around for more than a decade, lays out all the details about your debt, and helps you understand your credit score. Personal finance also helps you learn how to improve it. Credit Sesame offers free, useful, basic credit and debt tracking tools, but you'll need a premium subscription if you want a laser-focused view of your credit.

Credit Sesame backs up its free services by suggesting credit card and loan options that may be a better fit than what you're currently using. However, it does not track your income, expenses, and budget like Mint and Quicken Deluxe, our editors' choice for free or. Credit Sesame is more similar in content to Credit Karma and WalletHub, but lacks some of their tools.

The first screen you see in Credit Sesame is My Overview. This dashboard shows your credit score up, along with various ads scattered throughout the page.

The subscription levels of Credit Sesame

Credit Sesame offers four subscription levels. The free membership includes everything mentioned above, along with credit monitoring with alerts from a bureau. For $9.95 per month Advanced Credit adds daily credit scores from one bureau and a monthly credit report from all three major credit reporting agencies. The application for the $ 15.95-per-month Pro Credit Plan networks credit monitoring with alerts from three bureaus and 24/7 access to live experts who can help resolve credit score inaccuracies. Finally, Platinum coverage for 19 includes.95 USD per month the 24/7 protection against stolen / lost wallets, black market website monitoring, public records monitoring and social security number monitoring. Credit Sesame has added a new service since I last checked, Sesame Turbo, which reports rental payments to the credit bureaus (more on that later).

First steps

It doesn't take long to get an insight into your credit score. You need to provide some basic details about yourself, z. B. Your name, address and the last four digits of your social security number. Credit Sesame then creates your account and finds your current score.

Credit Sesame's dashboard (called My Overview) has changed significantly since the service was last reviewed. It offers less information than before, but you have to scroll more to see everything. You will also be frequently interrupted by financial product offers. The first thing you see is your credit score at the top of the screen. To the right is a chart showing changes in your credit score over the past six months. Links to two additional screens provide more detailed data and analysis. A (credit analysis) evaluates you on each of the factors that go into formulating your credit score. These are:

- Payment History. Have late payments or other negative marks on your credit history?

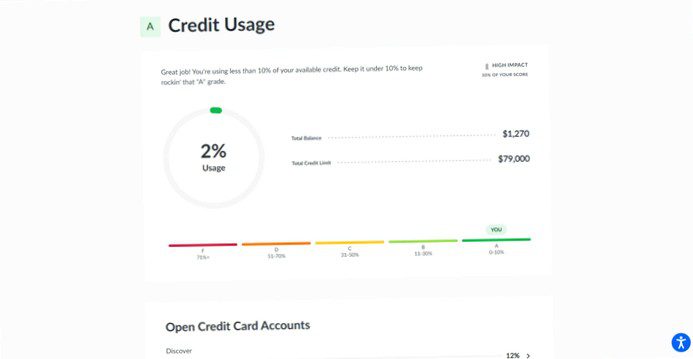

- Credit usage. Lenders want you to use no more than 30 percent of your total available credit.

- Credit age. How long are your accounts open?

- Account mix. Have a good choice of account types?

- Credit requests. Lenders don't like it when you apply for numerous accounts in a 12-month period.

Depending on how well you perform in these areas, Credit Sesame assigns you a letter grade such as A, B, or C and explains why you received that grade. Click on the Payment History tab, and you'll see a list of any late payments, collections, foreclosures or bankruptcies that appear on your credit report, along with a series of colored horizontal lines showing where you fall on the overall scale. This rating has a 35 percent impact on your credit score.

Credit Sesame assigns letter grades to the various factors that affect your credit score.

Debt analysis shows your total debt, total monthly payments, and debt-to-income ratio. Click on any of them, and the account mix screens will open along with your letter grade. It breaks down your debt into five types: Home loans, credit cards, auto loans, student loans and other loans, along with your accounts and account types.

Scroll down, and you'll find a list of all your debts, along with data such as the balance, minimum payment and percentage of credit limit you use for each. If you see something you want to dispute, there's a direct link to a page with information on filing a lawsuit. The Debt Analysis page proves particularly helpful when trying to understand your debt profiles.

Back to the dashboard

Previously, Credit Sesame data was accessible via links in the top half of the dashboard. I liked this design; it was a time saver, and it highlighted your credit information immediately. Now you need to scroll to see the most important content blocks. In addition, they are interspersed with an ad for Credit Sesame Premium (if you subscribe at the free level) and links to financial products. These recommendations are expected, but the dashboard now includes more advertising than editorial.

Credit Sesame also offers an additional navigation toolbar on the left side of the screen, replacing the old horizontal toolbar. It is top heavy with product offers. At least one of the old menu items, My Finances, is gone. Instead, there are links to product offers and promotions that you can include above. Below that is a link to Sesame Cash and credit monitoring notifications.

You can find out what your approval chances are for certain credit cards.

There's also a link to your full credit report, which you can only get if you subscribe to a paid version, and a link to your profile, which you should visit. Here you can edit your personal information and account settings, and turn notification emails on and off. If you're using the free version, there are two tabs that will take you to upgrade options.

Like its competitors, Credit Sesame also displays a link to its disclosure as an advertiser. This states that the company receives compensation from the financial product providers that appear on the site, but this only affects how and where their ads are placed, for example. All scores provided by Credit Sesame are independent of these partners.

A proactive approach

Each personal finance site that focuses on credit scores explains your score and suggests how to improve it. They also spell out the details of your debt in sometimes excruciating detail. In addition, they tell you exactly what actions you can take to increase your score.

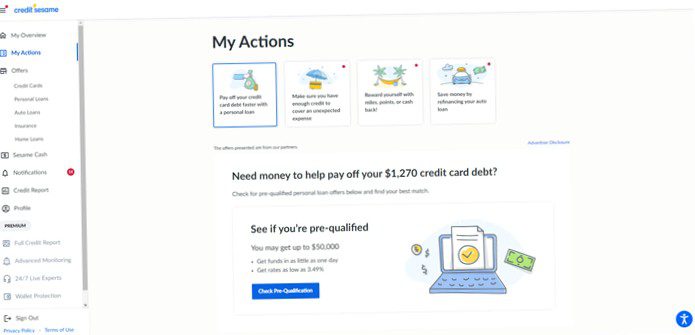

Credit Sesame applies what it knows about your financial profile to suggest possible solutions.

Credit Sesame is experienced in this. For example, if your credit score is pretty low, it applies what it calls credit potential. Next to your credit score is another circle with a higher number on it. If you follow the action plan outlined on the website, you should be able to upgrade to this second number. Credit Sesame can do this because it runs extensive simulations in the background to identify the actions that would be realistic given your credit history and that would help your score tick upward.

Sesame Cash

The company announced a new bank account in partnership with Community Federal Savings Bank, a member of the FDIC, more than a year ago, but it was not available when we last checked. It's now. Sesame Cash has no fees and doesn't require a minimum balance. You can transfer money to it from an existing bank account. The account comes with a debit mastercard (free withdrawals at over 55.000 ATMs worldwide) delivered and offers real-time activity notifications and up to $500 in free mobile device protection. If you sign up for direct deposit via your debit card, you may be able to get paid two days earlier, depending on your employer.

Beyond basic banking features, you can earn a daily credit score and be rewarded with cash (up to $100) when your credit score improves. You need to deposit $25 every 30 days to be eligible, which is not unreasonable. You may also be able to get cash back on eligible purchases. Note that this program has many rules and varies by location. Like the other offers, it can expire at any time.

Rental Reporting

It may not be common knowledge that paying rent conscientiously can affect your credit score. But you'll have to jump through some hoops – and pay some fees – to get your rent payment performance considered by the major credit reporting agencies. There are numerous companies that offer this service. Some charge an initial fee and then monthly fees that can vary widely.

Credit Sesame has acquired one of them: Zingo. So rental payment reporting is offered as a separate service, the Sesame Turbo for $15.95 per month. The company works with you and your landlord to report your rent payments monthly to TransUnion and Equifax. If you regularly pay on time, this could boost your credit score. You'll need to link your bank account to the service to verify your rent payments.

Credit Sesame's mobile apps

I didn't see much on the Credit Sesame website that wasn't available in the Android and iOS apps, but like the website itself, the free apps are heavy on product offers and lighter on data and advice. However, the apps look good and work great. As well as all of Credit Sesame's competitors. A toolbar at the bottom of the screen provides access to the apps' tools. The free edition's dashboard consists mainly of links to financial product offerings, but clicking on your credit score activates the second icon, credit. It is divided into two sections by tabs. These offer data and tools similar to the website's My Credit and My Debt pages.

Just like the browser-based version, Credit Sesame's mobile apps offer numerous suggestions for financial products that could serve you well.

A third icon takes you to Sesame Cash, where you can either sign up or sign out. Click on the Tips icon, and you'll see personalized suggestions for improving your credit score vulnerabilities, along with links to a number of helpful articles. The fifth icon will take you to credit card, auto loan, personal loan, home loan and insurance offers specifically selected for you. The apps almost replicate the website and contain the information you most likely want when you're away from your computer.

If you subscribe to a premium version, the dashboard is different. It provides a snapshot of key numbers, such as your credit utilization and available credit. Among them are links to premium features, followed by many ads for suggested financial products.

Good, but lacks some features

Credit Sesame's user experience is good and the mobile apps look and work even better. I like its debt tracking tools, and Sesame Cash can be a smart choice for people in subprime and underserved communities who have had bad experiences with traditional banks (or people who want to be rewarded for using cash as a way to improve their credit scores). Still, you can't see a credit report like Credit Karma in the free version. It pulls from only one credit bureau as opposed to two, and it lacks its competitors' simulators, calculators and other tools. It also lacks some features that WalletHub offers, such as the Debt Payoff Wizard. Credit Sesame's paid subscription tiers may appeal to you if you want more monitoring and access to experts, but you get more for free from competing sites.

Mint and Quicken Deluxe win this year's Editors 'Choice Awards for free, respectively. fee-based personal financial services. You can get your credit score and some related information from them, but their focus is on income and expense management, including budgeting and planning. That means there's no reason you can't use one of them in conjunction with Credit Sesame. The more resources you use to track your personal finances, the better.