Are you also one of the people who are looking for a 9000 euro loan? Do you have a project that urgently needs to be financed, but your current cash reserves do not give enough? Then a flexible 9000 Euro loan, which you get as quickly as possible, is a conceivable option to fulfill your wishes!

Compare now SCHUFA-neutral attractive 9000 euro loan offers!

In the free loan comparison can find numerous reputable providers who offer different terms and interest rates, u.a. depending on the monthly installment you plan to repay. But what other criteria are there to be able to apply for a 9000 euro loan and get it as quickly as possible?

The 9000 Euro installment loan at the bank

One of the best ways to get a cheap 9000 euro loan is to ask your own bank or another German bank. However, it should be clarified in advance whether your bank offers such a loan at all, since a 9000 euro loan is a so-called small loan.

9000 Euro loan as a small loan

Small loans usually go up to a sum of 10.000 euros, which therefore includes the 9000 euro installment loan, which in this case is a consumer loan to serve private consumption purposes. Of course, a commercial 9000 Euro loan for businesses can also be applied for, and essentially the application modalities do not differ too much.

In any case, for a long time it was not the case that ordinary banks offered such a small loan at all, as the effort involved in such a small amount was too high. Meanwhile, however, there are many German credit institutions, which have suitable products in the selection. If in doubt, however, ask by phone before going to your branch, so that you do not go to any trouble for nothing!

The requirements for a 9000 euro loan from the bank

By and large, the basic requirements are very similar – regardless of whether you want to apply for a 9000 Euro loan at the Sparkasse, Raiffeisenbank, Postbank, Deutsche Bank or any other German bank. Only if these are met do you have a chance of having your application approved. This includes:

- proof of a German residence

- a copy of your identity card or passport, so that your age of majority and your identity can be established without any problems

- the unrestricted business capacity, which would not be given, for example, in the case of mental impairment

- the existence of a German bank account

- Proof of a sufficiently high income (usually payslips or bank statements on salary transfers for the last few months)

- finally, the mandatory SCHUFA query, which is carried out by every German credit institution to check creditworthiness.

If you are one of the people who can meet these requirements, then you have very good chances of a favorable 9000 euro loan, which can then also be applied for quickly, approved and paid out. If, for example, your credit rating is not quite so good, but then all hope is not lost for a long time. Unlike employees who receive a regular monthly income, the self-employed can correspondingly not so easily provide proof of income.

9000 Euro loan for self-employed

Since a 9000 Euro without proof of income at a German bank is very unlikely, the creditworthiness of self-employed and entrepreneurs must be checked and confirmed differently. For this, some other documents are usually consulted, which would be:

- Financial statements of the last fiscal years

- Tax assessment notices for the last few years

- an economic evaluation (BWA) to the enterprise

- Further evidence of additional income such as z.B. Rental income

Entrepreneurs and self-employed people can also get a loan, but the credit check is somewhat more comprehensive. Should you not want to apply for a loan for consumption purposes, but for the business in terms of an investment or working capital loan, then the loan would be commercial in nature and also earmarked.

Certainly also in the case of the 9000 Euro consumer credit the probability of approval increases, if the money is to be used for a purpose clearly defined in advance. So ideally, specify what you need the loan for! Especially, if you want to buy a car or beautify your house, then you can use this fact positively for yourself!

Additional loan collateral for the 9000 Euro loan

In the case of earmarked loans such as the car loan or modernization loan, it is possible to finance the new car or. to deposit the house as collateral for the loan. While it is not the case with every bank that this is accepted for smaller loan amounts, as the security check also involves an effort, it is worth a try.

It is more likely, however, that you can name another borrower to additionally increase your credit rating! This is a helpful tip not only for the self-employed and entrepreneurs, but also for public employees and civil servants who actually have a high credit score innately, but want to improve their credit score even more

In this way, it is then possible to provide the bank employee with further arguments to offer the really most favorable loan with top interest rates, as the second borrower is also fully liable. If the second borrower has a high credit rating, which can be attributed mainly to a high monthly income, then part of the credit rating also "transfers" to the original applicant.

Fully digital instant loan iHv. 9000 Euro

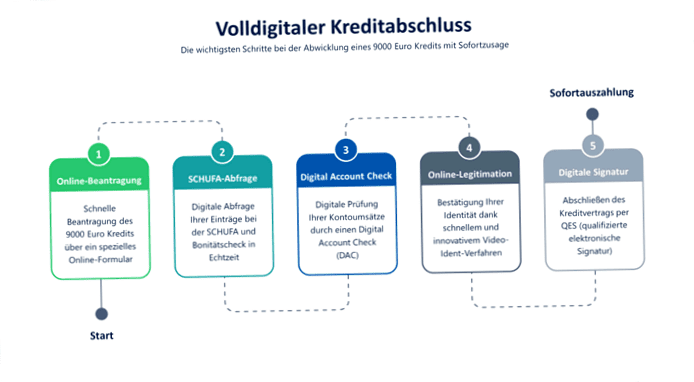

You need your 9000 Euro loan as soon as possible, preferably immediately, without a long waiting period? In such urgent cases, it can make perfect sense to apply for a real online loan with instant decision and real-time digital credit check.

Thanks to the Digital Account Check used here resp. the digital account view no bank visits or uploads of documents are necessary for successful borrowing. Software here checks your online banking information in minutes and creates a digital budget calculation, which is used as the basis for a credit decision. Of course, this requires that you have an online banking account.

The special software can access your sensitive account transaction data via the PSD2 API only after you authorize it to do so. Of course, it cannot make payments. Basically, the Digital Account Check is considered to be exceedingly secure, accurate and efficient.

If the digital account view has shown that you as a borrower have sufficiently high creditworthiness, the loan approval is granted immediately. Now you can successfully master online legitimation with the help of the Video-Ident procedure and subsequently sign the loan agreement with a legally valid qualified electronic signature.

An attractive fully digital loan with instant payment is, for example, the Kredit2Day, where, assuming creditworthiness, you can borrow a loan amount between 1.000 – 50.can take up 000 euros. Since it can come up with a real-time credit check thanks to Digital Account Check, it can rightly be considered as a lightning loan, fast loan, express loan or fast-track loan. If you would like more info on the Credit2Day, please click on this link!

9000 Euro credit without SCHUFA?

Many people are looking for a 9000 Euro loan without SCHUFA, but do not find it at German bank here. Because by default, every credit transaction involves an inquiry to SCHUFA Holding AG, the relevant credit bureau. This then gives out data that provides information about the credit history of the person in question and, in particular, calculates a score that determines the likelihood of repayment.

If, according to SCHUFA scoring, it is rather unlikely that you will reliably repay the monthly loan installments, then the chances of approval of the requested loan are not very good. A 9000 euro loan without SCHUFA query it can possibly. only give from foreign banks, which then, however, otherwise check the respective creditworthiness.

Attention: Even if you can find a credit institution that approves a 9000 Euro loan without SCHUFA, this is still no reason for joy. Because often the fees are sensitively high. In the worst case, even upfront costs are required with the risk of falling into a credit trap and ending up not only empty-handed but also having lost money.

Tip: Have your SCHUFA data sent to you once a year by the credit agency – this is offered free of charge. In the process, you can ggfs. have wrong or outdated entries corrected or deleted respectively. This procedure may help to improve your SCHUFA score. And a higher SCHUFA score also ensures a higher credit rating!

9000 Euro Loan from Private

If you can not get a 9000 euro loan from the savings bank or a 9000 euro loan without / despite SCHUFA from a foreign bank respectively. then there would be still the variant of the 9000 euro loan from private. This means that you are drawing the amount of money from a private person, and not from a commercial provider.

Perhaps you have a wealthy benefactor in your circle of acquaintances or count a particularly solvent person among your family members, who can give you a 9000 euro loan from private quickly and without problems? Then you may have hit the jackpot, because here even a 9000 euro loan without interest is possible, provided that the lending private person willingly waives interest income.

In other cases, you can find a 9000 euro loan offered by a private individual who is not personally connected to you through an online referral platform. Then it behaves however completely differently than with credit from the own circle of acquaintances, and it beckons frequently quite high fees and partly clearly worse interest rates. Then it may be better to obtain an ordinary installment loan from your local bank after all.

In any case, make sure that everything is properly documented, even if you receive the money from your rich uncle, who doesn't mind 9000 euros more or less on the account – everything should be correct, so that there is no family quarrel afterwards!

Conclusion: Many flexible options for the loan iHv 9000 Euro

Whether you want to renovate your apartment with the new 9000 euro loan, buy a used car or fly on vacation – there are many different options to get the money. The best way to compare the different offers is with the help of our free loan comparison, which shows you the best 9000 euro loans at top conditions.

Keep in mind that the APR can vary, sometimes significantly, depending on the term, monthly payment and credit score. If you have the 9000 euro loan over a long period of time, so z.B. If you want to repay the loan in 108 or 120 months, you will have to dig deeper into your pocket than if you repay the loan in 12, 24, 36, 48 or 60 months. But only you can know how many euros you can set aside each month to pay the repayments, and over what period of time you want to commit yourself contractually.