Have you been playing with the idea of applying for a 9500 euro loan for some time, because you need to make an important new purchase? Do you plan to beautify your home, re-tile the bathroom, build a conservatory or purchase new furniture?

Compare now without obligation interesting 9500 euro loan offers!

Also, if you simply want to bridge a financial bottleneck or need to reschedule debt because you have overstretched your expensive overdraft facility too much, then a 9500 euro loan offers itself as a conceivable solution. But where can you get such a 9500 euro loan cheap, fast and as uncomplicated as possible?

Here helps our free loan comparison, through which you can find the best loan offer at top conditions in just a few moments. Depending on the individual monthly rate or. Repayment rate and term there can be sometimes significant differences in the most favorable interest rates for the best 9500 euro loan from the bank.

The 9500 Euro loan as a small loan

The 9500 euro loan belongs to the genre of small loans, which are available up to an amount of 10.000 Euro go. You should note here that not every bank offers such a small loan, so you should ideally find out before going to your own house bank, whether such a product is available at all. A quick call to your bank advisor can quickly provide clarity, without you may be on the way for nothing.

Getting a cheap 9500 euro loan from the bank

For many people, an ordinary installment loan of 9500 euros, which they get from their house bank, is one of the best options to close the financial gap. However, you can only get the 9500 euro loan cheap from Sparkasse, Postbank or another well-known bank if you meet some requirements. These include:

- a permanent residence in Germany

- Full legal capacity, which excludes, for example, mental impairment

- A German checking account, to which the loan amount can be transferred

- the attained age of majority of 18 years

- a regular income, which makes the repayment of the 9500 Euro loan possible in the first place

- a sufficiently high SCHUFA score

For people who have a sufficiently high regular income and whose SCHUFA information gives a good score, it should therefore be no problem to meet all the requirements. Especially in the case of civil servants and public employees, the chances of obtaining a 9500 euro loan are favorable. The procedure may be more difficult for self-employed persons and entrepreneurs, not least because of the required proof of income.

Easy application to the 9500 euro loan for self-employed and entrepreneurs?

Even if the financial situation is often quite opaque, especially for self-employed sole proprietorships, there is no 9500 Euro loan without proof of income even for this target group. On the contrary, especially the 9500 Euro loan for the self-employed can usually be approved by banks only after a quite thorough examination of other documents. Relevant documents brought forward by self-employed workers usually include the following:

- Copies of the last tax assessment notices from the tax office

- Annual financial statements / balance sheets

- a meaningful business management report (BWA), which z.B. can be created by a tax firm

- Evidence of additional income (z.B. from investment income)

If you have these documents as a self-employed person, then you can significantly improve the chances of getting the 9500 euro loan quickly & easily. It is also still important to make a distinction between the consumer loan, which is used for private consumption, and a business loan, which is then applied for as an investment or working capital loan. In our case here we discuss mainly the personal loan. With the business loan, the funds may not be misappropriated and should serve the stated purpose.

Also with the consumer loan of 9500 euros it is very helpful if you can say in advance exactly what the amount will be used for. Often the money is used for a new kitchen, new furniture or even a new car, so that in the true sense of the word it can be called a home loan or car loan.

Collateralization of the 9500 Euro loan for easier approval

So if you want to use your 9500 Euro loan as a car loan, then it would be conceivable to bring in your vehicle as loan collateral. Accordingly, it is also possible with some banks to count the condominium or the house, if you want to use the loan to carry out renovation work or otherwise upgrade your home would like. Not every bank takes the trouble and recognizes this type of additional credit security for a small loan, but it is always worth a try!

Better conditions for your 9500 Euro loan by second borrower

One of the best ways to get the most favorable 9500 Euro loan from the bank is to name a second borrower. Unlike the guarantor or deficiency guarantor, the second borrower is fully liable for the loan from the outset, just like the actual applicant. If it should come contrary to expectation to payment defaults, then the second borrower is called to account, so that the contractually fixed repayment installments are also regularly repaid to the credit institution.

This is of course seen positively by the banks, so that you can calculate the risk especially with a high income and an excellent credit rating of the confirmatory applicant so that in the end a significantly better offer comes out and the 9500 Euro loan can be granted cheaply, quickly and easily. Civil servants and public employees can also take advantage of this fact!

Tip: If you are a young teacher still at the beginning of your career and possibly need. have only recently completed the clerkship, so the salary is not yet quite as high as may be necessary for a larger loan, then you can improve your credit rating immensely by a second borrower perhaps married to you and save money in the end, because you get the best possible 9500 euro loan with conceivably favorable interest rates!

Apply for a fully digital instant loan iHv 9500 Euro

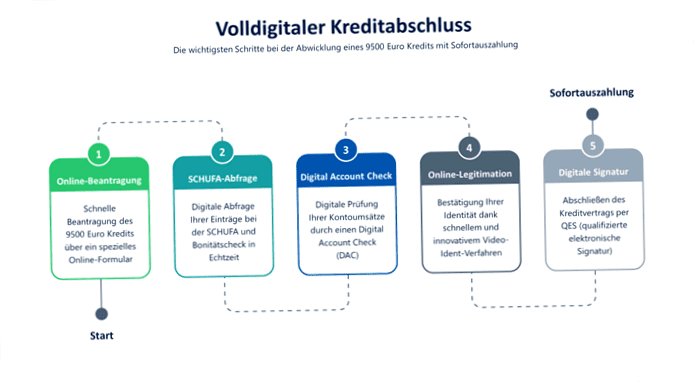

You do not want to have to wait unnecessarily long for the disbursement of your 9500 euro loan and are therefore looking for an instant loan with fully digital credit conclusion? Be glad to live in the digital age, because smart technologies like the Digital Account Check and the digital signature allow today to take out a 95000 Euro instant loan in real time – without waiting time and without paperwork! An important prerequisite for this is, of course, that you as a borrower have a sufficiently high credit rating!

The creditworthiness check is carried out completely online for the 9500 Euro digital loan – via digital account view or. Digital Account Check (DAC). Here you authorize a software to analyze and evaluate your online account data via XS2A interface. Since the Payment Services Directive PSD2 came into force, banks are required to provide such an interface for account information services.

So the DAC software sifts through your online banking data and categorizes income and expenses into a digital budget statement. The appropriate listing will then help it to grant your 9500 euro loan or not at all. Transactions, of course, the software cannot perform. You are simply giving her the ability to "look at your account" and evaluate data – strictly adhering to the GDPR guidelines!

A real online instant loan that offers real-time credit checks is, for example, the Kredit2Day offered by Smava. Quite rightly, this can also be called lightning loan without paperwork, express loan with immediate payment, express loan in 30 min or fast loan. If you would like more info on this offering, please just go to this subpage!

How about the 9500 euro loan without SCHUFA query?

A so-called 9500 Euro loan without SCHUFA does not exist at German banks, since every credit institution in this country checks the respective creditworthiness with the help of the credit agency based in Wiesbaden. SCHUFA publishes data, which it collects on over 60 million German citizens, and which documents relevant payment behavior.

If your previous payment history is rather mixed, then this can now have a negative impact on your credit rating. Please note that computer purchases on installments, mobile phone contracts and other purchases are also "tracked" as well as other bills that have not been paid even after repeated reminders.

A lack of payment morale in the youth can thus theoretically become the doom, although recently paid bills should not actually show up in new SCHUFA queries, as there are certain statutes of limitations. In case of doubt, you can always ask SCHUFA Holding AG and mind. receive one data transfer per calendar year free of charge.

You can get a 9500 Euro loan without SCHUFA possibly. from a foreign bank like z.B. Obtain a loan from Sigma Kreditbank AG in Liechtenstein, which follows in the tradition of Swiss banks that originally extended such loans to German borrowers, earning them the name "Swiss loans". These often boasted of comparably high fees. Perhaps it is also in your case to apply for the 9500 euro loan despite SCHUFA at a domestic institution.

Flexible design with the 9500 Euro loan from private

If you find neither the installment loan from the house bank nor the 9500 euro loan without / despite Schufa from a foreign bank favorable, then there would still be the possibility of the 9500 loan from private individuals. Here, ideally, a person you know will provide you with the 9500 euro loan from private, which can be very flexible and individualized. Especially if you are still young and fresh into professional life, then this can be a welcome opportunity.

Students and young entrepreneurs who are starting a startup may also receive evl. from family members or acquaintances of many years a necessary financial injection to favorable special conditions – in the ideal case even a 9500 euro credit without interest is granted to you, with which you receive thus quasi an interest-free loan.

In reality, however, it is often the case that even with the 9500 euro loan from private at least small interest is due. By the way, this can also come from an anonymous person, and then it often does not look so favorable in terms of interest and fees. Because the intermediary platforms also have to be paid, and that can add up nicely! Therefore, it may ultimately make sense to simply apply for the 9500 Euro loan at the bank around the corner, provided that the above minimum requirements are all met.

Conclusion: Individual options for the 9500 Euro loan

So you see that there are many different ways to get a 9500 euro loan. Now, if you want to get started conveniently online, just enter your desired term and loan amount, and you're ready to go without any complications. In particularly urgent cases, there may even be an instant loan, which is granted and paid out in 24 – 72 hours.