You need a 17000 euro car loan to finally buy a new car? Would you like to start a debt restructuring? Or are you just looking for a fair 17000 euro loan for free use?

Make a non-binding and SCHUFA-neutral loan comparison now! Get a detailed overview of the many different offers and discover the best and most favorable 17000 Euro loan for you from the comfort of your own home!

Compare attractive 17000 Euro loan offers now!

Not so long ago, when the World Wide Web did not yet exist, it was still common to apply for loans at classic branch banks or savings banks. Today, however, you have as a loan seeker literally the agony of choice. Because today consumers can get a 17000 euro loan not only from branch banks, but also from numerous direct and online banks.

The pressure of competition among all these banks is so great that there are only so many favorable offers! Finding these is the name of the game. So be smart and take enough time to compare a wide variety of offers! Because only in this way you will be able to find the most suitable and best 17000 Euro loan for you in the end!

17000 Euro credit = 17000 Euro loan

Due to the above the threshold of 10.000 Euro, the 17000 Euro loan no longer belongs to the small loans, but to the loans. So when you take out a 17000 euro loan, you are basically taking out a 17000 euro loan. The most important feature of a loan is a term of more than four years. This is with a loan iHv 17000 Euro usually also given.

Applying for a 17000 Euro loan from a German bank

You want to take a fair loan of 17000 euros from a German bank as soon as possible? Before you put your plan into action, you should first get an overview of the requirements that must be met by you in order to be able to take out a loan with a German bank.

Requirements for taking out a 17000 Euro loan with a German bank

- You have the 18. Have reached the age of majority and are fully capable of entering into legal transactions.

- Your official residence is in a municipality of the Federal Republic of Germany.

- You have a German current account.

- You can prove a regular income.

- You are considered reliable and willing to pay because your SCHUFA score is good.

To prove a regular income is not too big a hurdle for employees, salaried employees and civil servants, as they can present salary statements, pay slips, employment contracts and bank statements, which can testify to the regular income conditions. Entrepreneurs, tradesmen and self-employed persons, on the other hand, do not have such an easy time convincing the respective lender of a secure income situation. They cannot simply present a permanent employment contract, which guarantees the payment of a monthly salary.

Documents that business owners, tradespeople, and self-employed individuals must submit

- (Income) tax assessment

- Business Analysis (BWA)

- Financial statements / balance sheets (if available)

- Evidence of investment income, interest income and/or rental income

Credit assessment of German banks

Not only the knowledge of the requirements for taking out a loan from a German bank are relevant, but also the knowledge of the criteria that are examined in detail in the credit assessment of German banks and credit institutions.

Checking the income situation

The most important question examined during the credit check is: Does the applicant's income situation allow the requested loan to be taken out?? Or in other words: can the potential borrower afford the monthly installments of his desired loan at all?

If the applicant can come up with a high, regular income that allows him to repay the loan without any problems, the chances of getting a loan approval are good. However, if you only have a low income, which is just enough for the bare necessities, the cards are pretty bad.

Query SCHUFA data

Furthermore, it is important for a German credit institution to do business with a reliable borrower who is willing to pay. For this reason, the SCHUFA data of the applicant is requested.

Should the SCHUFA score of the applicant be high, the lender can assume that the same will pay his due bills on time and on schedule. However, if there is a negative SCHUFA entry, the credit seeker's willingness to pay is obviously not the best. Basically, banks and commercial credit institutions react very allergic to a negative SCHUFA.

Our tip: Before you apply for a loan of 17000 euros, you should make sure that all the data in your digital "SCHUFA file" is actually correct. From time to time, outdated or simply incorrect entries are found there! So be sure to make use of the free SCHUFA report that you are entitled to once a year, and be sure to have incorrect data deleted in order to improve your SCHUFA score if necessary. to increase!

Examination of collateral options

German banks and credit institutions check each applicant's collateral options in addition to income and SCHUFA data. And this is something you should definitely know, as collateral options can go a long way in getting approval for a particularly favorable 17000 euro loan!

The collateral options are basically divided into two types: on the one hand personal, on the other hand material loan collateral. The personal loan collateral includes the guarantee and the addition of a second borrower. Among the material loan collateral, which are also called real collateral, are mainly the land charge, the mortgage as well as the transfer of ownership by way of security.

Personal loan collateral to secure the 17000 Euro loan

The two personal loan securities operate similarly, but not identically. Indeed, the guarantor steps in only when the actual borrower is no longer able to repay his loan. The second borrower, on the other hand, is liable from the beginning in the same or similar manner as the first borrower.

Both methods are relatively popular with German banks and credit institutions, as they ensure that an initially uncertain loan transaction is ultimately approved. With the guarantee there are however different characteristics. And which type of guarantee is tolerated varies from bank to bank. For more information, please click here.

Real collateral to secure the 17000 euro loan

Real collateral can also be very effective and useful. Whereas in the case of land charge and mortgage, real estate and/or land are financially encumbered to adequately secure the 17000 Euro loan, in the case of chattel mortgage, a motor vehicle is provided as acceptable physical collateral.

Our tip: If you want to use your 17000 euro loan to buy a car or modernize your property, be sure to specify the purpose of use! Car loans and home improvement loans, in fact, are counted as purpose-built loans. And earmarked loans are commonly cheaper than consumer loans for free use!

In the case of car loan, the car to be purchased can also be put right away as additional real collateral. This reduces the default risk of the lending bank and usually leads to better conditions.

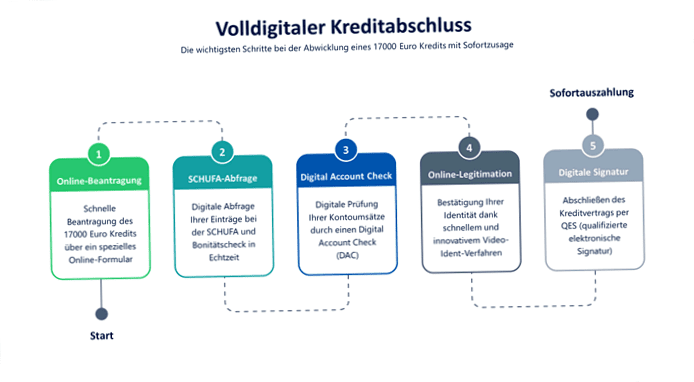

Full digital loan iHv 17000 Euro with instant decision

You are looking for a quick and easy 17000 Euro loan?? In this case, you should think about taking out a fully digital loan with instant decision and instant payment. This type of loan eliminates time-consuming visits to a bank branch and the labor-intensive process of gathering and mailing documents of all kinds.

A true digital loan iHv 17000 euros can be applied for completely online and processed in real time. Innovative technologies like digital account check, video ID and digital signature make it possible. Since this is the case, the fully digital loan is considered to be particularly efficient and sustainable, as it is completely paperless!

With the appropriate credit check, you do not even have to provide documents via upload. The SCHUFA query is carried out digitally in real time here. And your income-expense situation is verified online by software that follows an intelligent algorithm.

Specifically, the Digital Account Check, which is also known as digital account check in German, works as follows: you authorize software to analyze and evaluate your account data via the so-called PSD2 API. The evaluation categorizes your monthly income and expenses and compares them for a digital budget statement. If the software infers from your data that you have a sufficiently high credit score to take out the 17000 Euro instant loan you are applying for, it immediately gives the green light to grant the loan.

A real online loan, where you can, provided creditworthiness, receive the loan amount immediately to your account, is for example the Kredit2Day, which is awarded by Smava GmbH in cooperation with solarisBank AG. Since the entire process is fully digital and paperwork-free, this loan can quite rightly be called a quick loan, lightning loan, express loan or fast loan.

17000 Euro loan without SCHUFA

You have a negative SCHUFA record and no one who wants to vouch for you or be a second borrower? Because of this, they are pursuing the intention of applying for credit without SCHUFA in other European countries? In principle, it is possible to take out a "Swiss loan" where no SCHUFA query is made. However, whether this makes economic sense is a moot point.

Our tip: Before you apply for a high-cost loan without SCHUFA abroad, you should be able to 100% exclude that you can provide loan collateral – of whatever kind. Please check all your options carefully! Because applying for a fair 17000 Euro loan in Germany with the help of loan collateral is basically cheaper than taking out a "Swiss loan" abroad!

Credit check without SCHUFA

You feel that you have no choice but to apply for a SCHUFA-free loan abroad? If so, before you start looking, you should realize that, of course, foreign credit institutions also conduct a credit check, which includes a more detailed analysis of income. After all, a credit check without SCHUFA does not mean that there is no credit check at all! Therefore, if you do not have a regular income, it does not make sense to look for a loan abroad.

Fraud cases in the 17000 euro loan without SCHUFA

At this point, the team of KREDIT 123 would like to point out that when applying for a 17000 euro loan without SCHUFA, unfortunately, fraud can occur. These often come in the form of completely overpriced upfront costs. It is also possible that dubious credit brokers try to sell you expensive products that you do not need, such as residual debt insurance at horrendous costs. So please let the necessary caution be exercised here!

17000 Euro loan from private

On the one hand, loans can be granted by banking and credit institutions, but on the other hand, loans can also be granted by private lenders. And with these, there are two types: the known and the unknown.

17000 Euro loan from a well known private lender

As the term suggests, the loan comes from a known lender from one's own family or acquaintance circle. This type of loan is one of the most favorable, as even interest-free loans are possible here. It should be taken into account, however, that if the approach is unprofessional, the tax office might get the idea to classify the corresponding money transfer as a gift. And if this happens and the loan amount becomes above the gift tax allowance, payment of gift taxes is due!

17000 Euro loan from a unknown private lender

In contrast to the type of credit just presented, the loan from an unknown private lender is considered a relatively costly option. This is u.a. also remember that fees are payable when using an online referral portal, provided a loan agreement has been successfully completed.

Our conclusion on the 17000 euro loan / 17000 euro credit

You don't have an acquaintance that will lend you 17000 Euro interest free loan? In this case, we find that the best option is to apply for a fair and cheap 17000 Euro loan from a commercial lending institution in Germany. Because with a high credit rating, credit seekers can benefit from very low interest rates.

If your credit rating is not particularly good, you can try to increase your credit score by posting loan collateral. Furthermore, before applying for a larger loan, you should definitely ensure that false or outdated entries (if any) are deleted from your SCHUFA file.

From taking out a loan without SCHUFA, we generally advise against, because here usually very high interest rates are to be paid. In general, the "Swiss loan" should be considered as the very last option (ultima ratio).

Professional loan agreement in writing

Anyone who takes out a loan, no matter from whom, should generally make sure that the loan transaction is based on a fair, professional loan agreement in writing. Because only if all clauses are consensual and clearly regulated in the contract, it is guaranteed that there can be no misunderstandings or inconsistencies.

Detailed credit comparison in the search for a 17000 euro loan

In the end, we would like to point out once again that it is very useful to make a detailed loan comparison when looking for a 17000 euro loan. In this way, you can locate your desired loan relatively easily and quickly. Any borrower who is intelligent will take the time necessary to discover the best and most favorable offer!