You need a 11000 euro loan because your income is not sufficient to finance a major purchase? You would like to e.g. Renovate your house or buy a new car? Then feel free to use our loan comparison and find the best deal with attractive top interest rate!

Compare different 11000 euro loan offers now – no obligation!

With the free loan comparison, you can easily and conveniently compare different offers at the touch of a button online and also apply on the Internet, so you do not have to visit a bank branch first.

Use the 11000 euro loan to reschedule debts

Even for a 11000 euro debt rescheduling loan, it may make sense to head to the online bank, since you may have to permanently overdraw your checking account with large amounts or still pay off another loan from gray times ago, which was given only at an unfavorable interest rate due to poor credit rating.

There are many more reasons to take out a 11000 Euro loan from Sparkasse, Raiffeisenbank, Commerzbank, Postbank or any other – what these installment loans always have in common is that important requirements have to be met so that you can apply and the 11000 Euro loan can be granted after a thorough examination.

Requirements for an 11000 euro loan from the bank

In principle, the 11000 euro loan (resp. in the case of a term of at least 48 months, the 11000 euro loan) be granted by the bank only if the following circumstances:

- They are fully capable of doing business and credit, d.h. You are not mentally impaired.

- The 18. Year of life you have already reached.

- They are registered in Germany resp. have a German residence.

- Receive a regular income that is high enough to pay the monthly principal payments.

- You have a good credit rating, which u.a. Is verified by an inquiry at SCHUFA in Wiesbaden, Germany.

11000 Euro loan without SCHUFA?

The verification in cooperation with SCHUFA Holding AG is, by the way, carried out by every German bank, both when you apply for the 11000 Euro loan as a private person and when a company is the applicant. SCHUFA collects relevant data on all German citizens, from which the so-called SCHUFA score is determined. This is authoritative to assess the credit default risk. If you achieve a very high score, then the prospects for approval are very good, as you appear to have a high credit score.

A 11000 Euro loan without SCHUFA query is then at best from a foreign bank, which will also check your creditworthiness in any case. Previously, it was first Swiss banks that offered such 11000 euro loans without SCHUFA or. Have offered without Schufa query, which led to the colloquial term "Swiss loans". Nowadays there are u.a. in Luxembourg and Liechtenstein relevant institutions, which offer such products at higher fees.

You should be careful in any case, if you are offered a 11000 euro loan without Schufa, where so-called pre-costs are demanded. This means that you will be asked to pay before you see a single cent.

You may end up looking down the tubes on these deals and never receive a transfer because you've been taken in by scammers! So you should consider whether you want to take the risk or rather go to the bank and the corner to apply for the 11000 euro loan there despite negative SCHUFA.

The 11000 euro loan for self-employed

Employees of private companies, public employees and civil servants often have no major problems with the minimum requirements of the banks. The situation is different with self-employed persons and entrepreneurs. This is mostly due to the fact that self-employed people cannot always prove a high enough income.

Sometimes business is better, in other cases seasonally not so good, and then the monthly salary fluctuates. Therefore, the 11000 Euro loan for self-employed, freelancers, tradesmen & entrepreneurs there are still the following requirements:

- Submission of annual financial statements and balance sheets

- Copies of the last tax assessment from the tax office

- Business management report, prepared by a tax advisor or accountant

- further proof of income, for example, from rental income or stock profits

Additional loan collateral in the 11000 euro loan

In order to be able to improve your creditworthiness further, a collateralization of the loan often offers itself. Here, a basic distinction can be made between real and personal credit collateral. In the case of larger purchases, it makes sense, for example, to offer a tangible loan collateral.

If you want to use the 11000 euro loan to renovate your house, tile the bathroom new or remodel the garden, then taking out a mortgage would be a good idea. In the case of a car purchase would be accordingly a security transfer of title conceivable, whereby you hand over the vehicle title to the bank until the full repayment of the 11000 euro car loan and then get back afterwards.

Personal loan collateral in the 11000 euro loan

Also welcome are personal collateral. For instance, the surety bond is a popular option, and there are basically the directly enforceable surety bond and the indemnity bond. Family members or good acquaintances and friends often offer themselves as guarantors. Even better in the eyes of the bank would be if you have a second borrower, who ideally has a good credit rating.

Unlike guarantees, additional borrowers are fully liable for the 11000 Euro loan from the beginning, should the first applicant be unable to meet the contractual obligations. The bank then does not have to wait for the first borrower to respond or even go to court in the case of a deficiency guarantee, which only makes the guarantor liable after the legal route has been taken.

Also young civil servants or. By the way, civil servant aspirants can make use of this possibility of the second borrower to additionally increase their credit rating and have the best chances to get the cheapest possible 11000 euro loan at top conditions from the bank. Especially if you z.B. as a civil servant or employed teacher are still at the beginning and the salary is rather manageable, this form of personal security can make a lot of sense.

Fast 11000 euro instant loan with fully digital processing

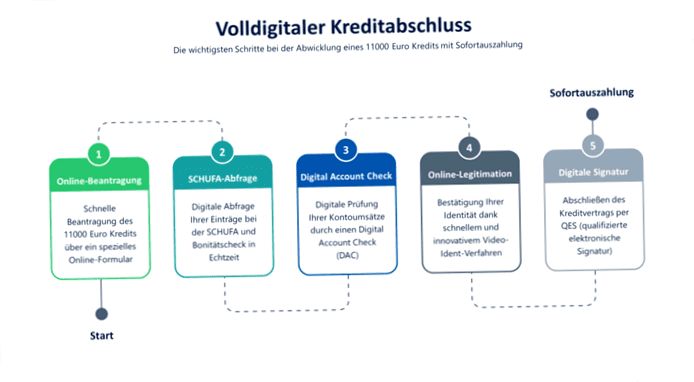

You are looking for a quick 11000 euro loan that can be completely processed in just a few minutes? In such a case, you should apply for a fully digital instant loan with digital credit check in real time! The entire process is carried out completely online and within just a few minutes.

You are just wondering how this is possible? – Innovative technologies such as the Digital Account Check ensure that the credit check is carried out precisely, efficiently and in real time by intelligent software. The contract is concluded thanks to the video identification process and QES, which stands for qualified electronic signature.

All steps up to the immediate disbursement take place paperless and in real time, which is why real digital loans can also be considered contemporary and sustainable. Not without reason they are also called lightning loans, fast loans, express loans or express loans. A very good offer in this context is, for example, the Kredit2Day, which is advertised by smava GmbH and awarded by solarisBank AG. More information about Kredit2Day can be found here!

The 11000 Euro credit from private

If you are of the opinion that a 11000 Euro loan from the bank is out of the question due to various factors, then a 11000 Euro loan from private individuals may be the right alternative for you. In this case, the backer is not a profit-oriented business enterprise, but a private individual.

This can be, for example, a wealthy acquaintance from your environment, your parents or the rich uncle without own children. In particularly favorable cases, you will then even manage to get a 11000 euro loan without interest, since your benefactor may waive this completely. However, with all this unexpected good fortune, remember to put everything in a written contract so that there are no unpleasant surprises later on.

Even from anonymous people you can get the 11000 euro loan from private, if you go to one of the few platforms on the Internet. For an often high fee, you will then be given the opportunity to enter into a corresponding connection and the credit transaction. In the end, however, it may be the 11000 Euro installment loan despite SCHUFA from the house bank that suits you best and is still the most favorable variant of all – especially if you can provide loan collateral.

Tip: If in doubt, make a free inquiry at SCHUFA Holding AG in Wiesbaden up to once a year. It then provides you with the data collected about your payment history. Normally, recently lapsed payments, which have also been settled long ago, should no longer be entered there. But in some cases, former creditors and debt collectors fail to report the dunned amounts to the SCHUFA after payment.

Conclusion on the 11000 Euro credit / 11000 Euro loan

If you have a good credit rating and meet all the above requirements, then your 11000 Euro online loan is actually no longer much in the way. However, even if you have a negative SCHUFA, if you have suitable loan collateral, you can still turn the tide and make the bank advisor favorable, so that the loan can be granted.

Just take a moment to think about what term works for you. As a rule of thumb, a shorter term of perhaps 12, 24 or 36 months usually means a cheaper APR. But also with a 11000 Euro loan with 48, 60, 72 months or also clearly longer with 108, 120 or 144 months, if that is offered by the bank at all, there can be comparably favorable conditions.

Another tip: When taking out an 11000 euro loan, always specify the intended use as precisely as possible, too. Thus, you can definitely score points in the conversation with the bank employee by not simply wanting to take out a loan for free use to satisfy x-any consumer desires, but as described above, you want to use the loan as a house, furniture or car loan.

Start now the free loan comparison and find the best offer! If all the required documents are ready, then things can move very quickly, so you can get the money paid out in just a few days!